How To Choose Your Side Hustle: 7 Practical Tips

Did you know that 39% of Britons now have a side hustle, with the average earner pocketing an extra £5,000 per year? These days, that’s almost enough for a night out AND a taxi home!

This article is big, so I’ll get right to it. I’ll be giving you 7 actionable tips to help you choose the side hustle that suits you best. Here they are.

#1 Assess Your Skills and Interests

When trying to figure out how to choose your side hustle, it’s a good idea to first think about what side hustles you already fit the mold for.

Identify Your Unique Talents and Expertise

We’ve all got something we’re good at, even if we don’t always realise it.

Take a few minutes to jot down your skills. Are you good with words? Perhaps numbers are more your thing. Or maybe you’ve got a knack for fixing things around the house.

Don’t just think about your professional skills, though. Consider your soft skills too. Are you great at managing your time? Do people often come to you for advice? These skills can be just as valuable in the gig economy as technical know-how.

There are different ways to apply your skills too. I’m good at fixing things, and while I wouldn’t want to be a handyman, those skills are useful for running our AirBnb or renovating properties.

Could You Monetise Your Hobby?

What do you enjoy doing in your spare time? Your hobbies could be a goldmine waiting to be tapped. Do you spend your weekends baking? There might be a market for your homemade treats. Are you constantly rearranging your furniture? Interior design consulting could be right up your street.

Remember, the best side hustles often come from combining what you’re good at with what you love doing.

What About Professional Experience?

Your day job might be more useful for your side hustle than you think. Take a look at your CV and think about how your professional skills could be applied in different contexts. For instance, if you’re in customer service, you’ve likely got excellent people skills that could translate well to a tutoring or coaching gig.

Don’t underestimate the value of industry knowledge either. If you work in finance, for example, you could offer budgeting advice or financial planning services. Insider knowledge pays well if you know how to share it effectively.

Create Your Skills and Interests Inventory

Now that you’ve brainstormed your skills, hobbies, and professional experience, it’s time to organise this information into a useful format. Creating a skills and interests inventory will give you a clear picture of what you bring to the table.

Start by making a simple table with three columns: Skills, Proficiency, and Interest Level. In the Skills column, list everything you’ve identified – from technical abilities to soft skills. Don’t hold back; include everything you can think of.

Next, rate your proficiency in each skill on a scale of 1-5, with 5 being expert level. Be honest with yourself here. It’s okay if you’re not a 5 in everything – that’s what makes you unique.

In the Interest Level column, rate how much you enjoy using each skill, again on a scale of 1-5. This step is crucial because the best side hustles often come from skills you actually enjoy using.

Here’s a quick example of what your inventory might look like:

| Skill | Proficiency (1-5) | Interest Level (1-5) |

| Writing | 4 | 5 |

| Social media management | 3 | 4 |

| Basic web design | 2 | 3 |

| Public speaking | 4 | 2 |

Once you’ve completed your inventory, take a good look at it. The skills with high scores in both proficiency and interest are your sweet spots. These are the areas where you’re most likely to find a side hustle that’s both profitable and enjoyable.

Keep this inventory handy as you explore different side hustle options. It’ll serve as a valuable reference, helping you quickly assess whether a potential gig aligns with your strengths and interests.

Remember, this inventory isn’t set in stone. Update it as you learn new skills or discover new interests.

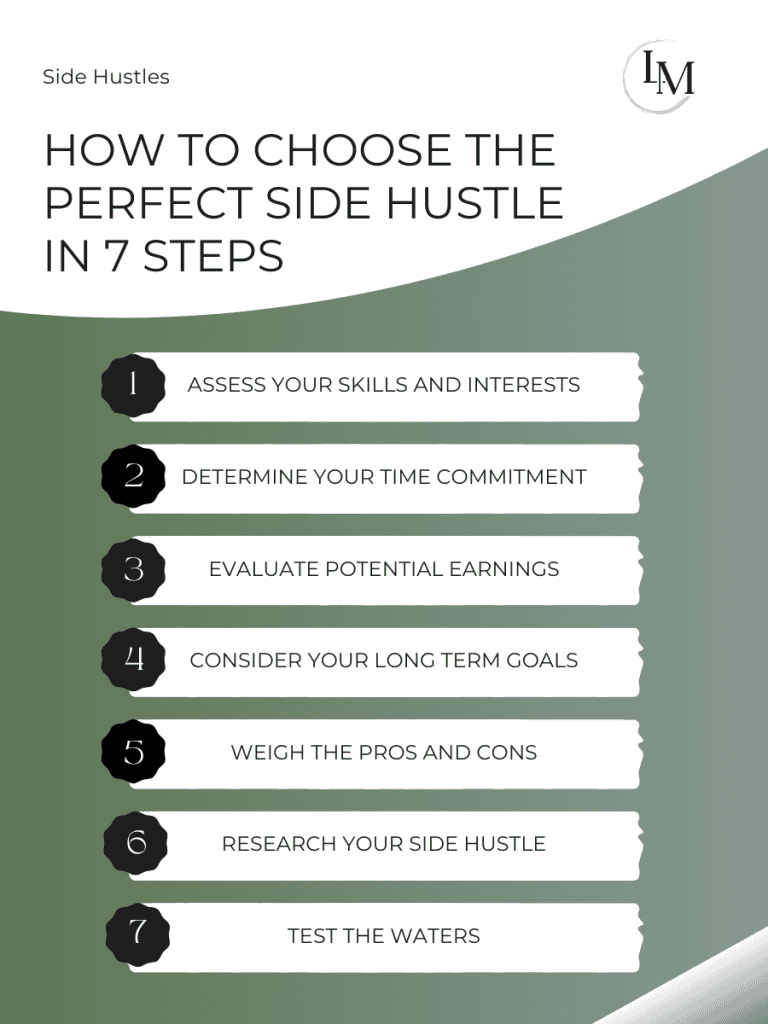

#2 Determine Your Time Commitment

When it comes to side hustles, time is arguably your most valuable resource. Before committing to any gig, you should understand how much time you can realistically dedicate without burning yourself out or neglecting your dog.

Analyse Your Current Schedule

Start by taking a hard look at your typical week. How many hours do you spend at your main job? Don’t forget to factor in commute time, overtime, and any work you might bring home. Next, consider your personal commitments – time with the kids, or that quick 4 pints after work all need to be factored in.

Once you’ve accounted for these essentials, what’s left? This is your potential side hustle time. Be honest with yourself here. If you’re only finding an hour or two a week, that’s okay – it just means you’ll need to choose a side gig that fits within those constraints.

Consider the Flexibility of Different Side Hustle Options

Different side hustles have different time demands. Some require set hours, while others offer more flexibility:

- Fixed Schedule Gigs: These include things like tutoring, giving music lessons, or working retail shifts. They often require you to commit to specific times each week.

- Flexible Gigs: Freelance writing, graphic design, or selling items online fall into this category. You can often do these whenever you have spare time.

- Passive Income Gigs: These require an upfront time investment but can generate income with minimal ongoing effort. Think affiliate marketing or creating and selling digital products.

Assess Your Energy Levels

Time isn’t just about hours on a clock – it’s also about energy. Be realistic about when you’re at your best. Are you a night owl who could happily work on projects after your day job? Or are you an early bird who could squeeze in some side hustle work before heading to the office?

Understanding your energy patterns will help you choose a side hustle that aligns with your natural rhythms.

Create a Time Budget

Just as you’d create a financial budget, it’s helpful to create a time budget for your side hustle. Here’s how:

- Start with a weekly total of hours you can dedicate to your side gig.

- Break this down into daily allocations. For example, 1 hour on weekdays and 3 hours each on Saturday and Sunday.

- Factor in any seasonal variations. Perhaps you have more free time in summer or less during the holiday season.

- Include buffer time for unexpected tasks or learning curves.

Your time budget will serve as a reality check when you’re exploring different side hustle options. It’ll help you avoid overcommitting and ensure you’re choosing a gig that fits your lifestyle.

Plan for Scalability

As you determine your time commitment, think about the future too. Is your goal to keep this as a small side project, or do you hope to grow it into something bigger? Some questions to consider:

- Could you increase your time commitment in the future if the gig takes off?

- Is there potential to outsource or automate parts of the side hustle as it grows?

- How would scaling up impact your main job and personal life?

Having a clear vision of your long-term goals will help you choose a side hustle with the right growth potential for you.

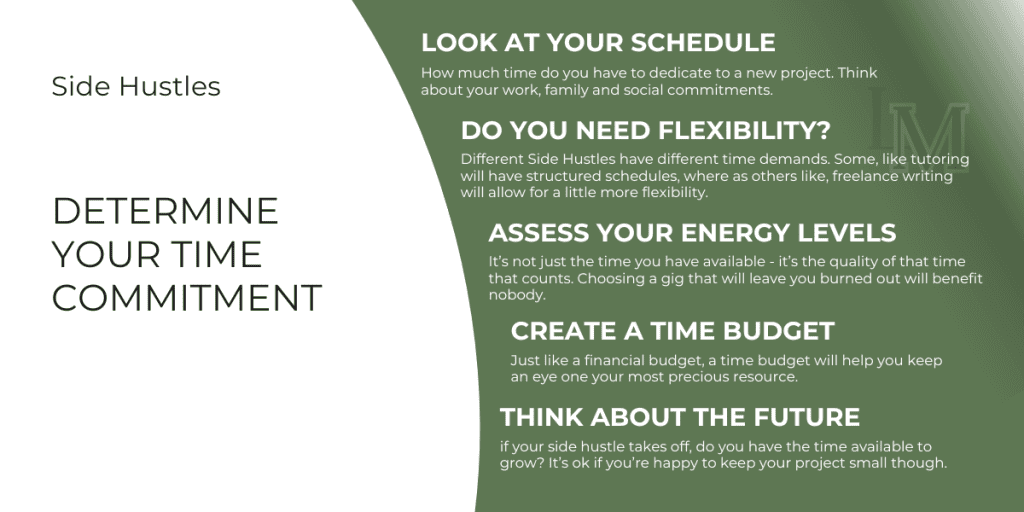

#3 Evaluate Potential Earnings

Knowing how much you can earn from a side hustle is one of the most important deciding factors. After all, you’re investing your precious time and possibly some hard-earned cash, so you’ll want to ensure you’re getting a decent return on that investment.

Research Average Earnings

You need to get a realistic idea of what others in your chosen field are actually earning. This isn’t about pie-in-the-sky dreams; it’s about cold, hard facts.

Start by looking at websites like Glassdoor, Indeed, or PayScale for salary information related to your potential side hustle. These sites often have data on freelance and part-time rates as well as full-time salaries.

You can also check out the platforms you plan on using to figure out how much other gig workers in your field are earning.

Don’t forget to check out Reddit forums or Facebook groups dedicated to your chosen field – these can be goldmines of real-world earning information.

Remember, though, that these figures can vary widely based on factors like:

- Location (London rates will likely be higher than those in smaller towns)

- Experience level (newbies often earn less than seasoned pros)

- Demand for the skill (hot skills command higher rates)

- Seasonality (some gigs pay more during peak seasons)

Look for median earnings rather than averages, as these are less likely to be skewed by outliers.

Earning Potential vs Time Investment

It’s not just about how much you can earn, but how efficiently you can earn it. This is where the concept of your effective hourly rate comes into play.

To calculate this:

- Estimate your monthly earnings from the side hustle

- Estimate the number of hours you’ll work per month

- Divide earnings by hours to get your hourly rate

For example, if you expect to earn £500 per month from freelance writing, and you estimate you’ll spend 25 hours per month on it, your effective hourly rate would be £20.

But don’t stop there. Compare this rate to other potential side hustles, and to what you earn in your day job. Is it worth your time? Remember, your free time is valuable – make sure you’re using it wisely.

Factor in Startup Costs and Ongoing Expenses

Many would-be side hustlers make the mistake of focusing solely on potential income without considering the costs involved. Don’t fall into this trap. Be thorough in identifying and estimating all potential expenses.

These might include:

- Equipment or tools (e.g., a high-quality camera for photography, or a powerful laptop for graphic design)

- Software or subscriptions (like Adobe Creative Suite for designers or Grammarly for writers)

- Marketing expenses (website hosting, business cards, online ads)

- Platform fees (Etsy, eBay, or Fiverr all take a cut of your earnings)

- Training or certifications (to enhance your skills or credibility)

- Travel costs (if your gig requires you to move about)

- Insurance (public liability insurance might be necessary for some gigs)

Create a detailed list of all potential costs, both one-time and recurring. Then, subtract these from your projected earnings to get a more accurate picture of your potential profit.

Projection and Growth Potential

While it’s important to consider immediate earnings, don’t forget to look at the bigger picture. A side hustle with strong growth potential might be more valuable in the long run than one with higher initial returns but limited scope for expansion.

Ask yourself:

- Is there room for growth in this field? Could you take on more clients or raise your rates over time?

- Are there opportunities to upsell or cross-sell additional services?

- Could you eventually outsource some tasks, allowing you to take on more work without increasing your own hours?

- Is there potential to create passive income streams within this hustle? (For example, a freelance writer might create and sell e-books)

Create Multiple Income Scenarios

To get a comprehensive view of your earning potential, it’s helpful to create multiple income scenarios. Consider:

- Best-case scenario: What if you land high-paying clients or your products sell better than expected?

- Worst-case scenario: What if work is slower to come in or you face unexpected challenges?

- Most likely scenario: Based on your research, what’s the most realistic outcome?

I go through cycles of hitting best case, most likely and worst case a few times a year. The good months and the bad months do tend to balance themselves out, especially with things like Airbnb.

Tax Implications

In the UK, you’ll need to declare your side hustle income to HMRC. If you earn more than £1,000 from your side gig in a tax year, you’ll need to register as self-employed and complete a self-assessment tax return.

Consider setting aside about 20-30% of your side hustle earnings for tax. It’s better to overestimate and have a pleasant surprise than to be caught short when the tax bill comes due.

Evaluating potential earnings isn’t an exact science. There will always be some level of uncertainty. However, by researching and considering all these factors, you’ll be able to make an informed decision about whether a particular side hustle is financially worthwhile for you.

Benchmarking Against Living Costs

Once you’ve figured out how much a side hustle pays, you need to be able to put those earnings into perspective. After all, £500 a month might be a game-changer in one area but barely cover the basics in another.

Compare to Local Living Costs

Start by considering how your projected side hustle income stacks up against your local cost of living. Here’s how:

- List your monthly essential expenses (rent/mortgage, utilities, food, transport, etc.)

- Compare your potential side hustle earnings to this total

For example, if your monthly essentials come to £1,000 and your side hustle could earn you £300 a month, that’s covering 30% of your basic living costs – not too shabby for a side gig!

Don’t forget to consider regional variations. A dog-walking side hustle might cover half your rent in Sheffield, but only a fraction of it in central London.

Contribute to Specific Financial Goals

How could your side hustle earnings could contribute to your broader financial objectives? Are you:

- Saving for a house deposit?

- Trying to pay off student loans or credit card debt?

- Building an emergency fund?

- Saving for a dream holiday or wedding?

- Trying to build a swimming pool in your basement for your dog?

Let’s say you’re aiming to save £5,000 for a home repairs safety net. If your side hustle could consistently earn £200 a month, you’d hit that target in just over two years from this income alone. Suddenly, that goal seems much more achievable!

Evaluate Impact on Overall Financial Wellbeing

How would additional income improve your overall financial health? Could it:

- Reduce your reliance on credit cards for unexpected expenses?

- Allow you to start investing for the future?

- Give you a buffer to pursue career development opportunities in your main job?

- Provide peace of mind and reduce financial stress?

For instance, if you’ve been living paycheck to paycheck, an extra £150 a month might be the breathing room you need to start building savings and feel more financially secure.

The value of your side hustle isn’t just in the raw numbers – it’s in how those earnings can improve your quality of life and financial stability. A side gig that helps you sleep better at night knowing you’re making progress on your financial goals can be worth its weight in gold.

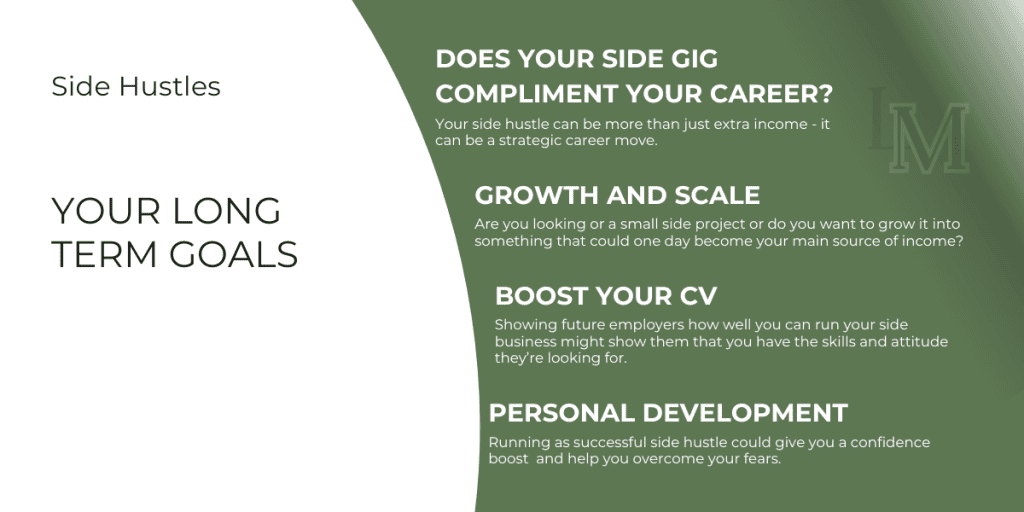

#4 Consider Your Long-term Goals

A well-chosen side gig can be a stepping stone to greater things, while a poorly chosen one might lead you down a path that doesn’t align with your aspirations.

Determine if the Side Hustle Aligns with Your Career Aspirations

Your side hustle can be more than just extra income – it can be a strategic career move. Here’s how to evaluate the alignment:

Skill Development

Think about whether the skills you’ll gain or hone in your side hustle are valuable in your career.

For example:

- If you’re in marketing and start a social media management side gig, you’re directly enhancing relevant skills.

- If you’re an accountant who takes up freelance writing, you might be developing communication skills that could help you move into a management role.

Industry Exposure

Does your side hustle give you exposure to an industry you’re interested in? This can be particularly valuable if you’re considering a career change. For instance:

- A teacher who starts tutoring coding on the side might be paving the way for a transition into the tech industry.

- An office worker who launches a weekend photography business could be laying the groundwork for a creative career shift.

Network Expansion

Think about the networking opportunities your side hustle might provide. Will you:

- Meet potential mentors in a field you’re interested in?

- Connect with clients who might become valuable contacts?

- Join professional groups or attend events related to your side gig?

Assess Potential for Growth and Scalability

It’s important to consider where your side hustle could lead. Is it just a temporary money-maker, or could it evolve into something more substantial?

Consider How the Side Hustle Might Look on Your CV

A well-chosen side hustle can enhance your CV. Here’s how to evaluate its impact:

Demonstrating Initiative

A side hustle shows potential employers that you’re:

- Proactive and self-motivated

- Able to manage time effectively

- Willing to go above and beyond

Relevant Experience

If your side hustle is related to your career, it can serve as valuable experience.

For example:

- A aspiring writer who maintains a successful blog as a side hustle has a ready-made portfolio.

- Someone looking to move into project management can highlight the organisational skills used in running their e-commerce side business.

Entrepreneurial Spirit

Showing your employer you’re a ‘get stuff done’ kind of person can go a long way.. Your side hustle can demonstrate:

- Creative problem-solving skills

- Ability to identify and capitalise on opportunities

- Financial acumen and business sense

Personal Development Opportunities

Beyond career and financial benefits, how could your side hustle contribute to your personal growth?

Skill Acquisition

What new skills will you learn? These might include:

- Technical skills (e.g., coding, design software)

- Soft skills (e.g., negotiation, public speaking)

- Business skills (e.g., marketing, accounting)

Personal Challenges

How will this side hustle push you out of your comfort zone? Will it:

- Boost your confidence in a particular area?

- Help you overcome fears (e.g., public speaking, selling)?

- Teach you to handle criticism or rejection?

Work-Life Integration

Consider how this side hustle fits into your ideal lifestyle:

- Does it allow for the flexibility you desire?

- Can it be done remotely, supporting dreams of travel or relocation?

- Does it bring you joy or fulfilment beyond the financial rewards?

Building a Personal Brand

Your side hustle can be a powerful tool for developing your personal brand:

- How does it contribute to your professional identity?

- Can it help establish you as an expert in a particular field?

- Does it align with your values and the image you want to project professionally?

#5 Weigh the Pros and Cons

Take a step back and objectively evaluate the advantages and disadvantages of your side gig.

Create a Comprehensive Pros and Cons List

Start by creating a list of pros and cons for each side hustle option you’re considering. Be thorough and honest with yourself. Here are some factors to consider:

Pros to Consider:

- Financial benefits (extra income, potential for growth)

- Skill development opportunities

- Networking possibilities

- Flexibility in work hours

- Potential tax benefits (e.g., claiming business expenses)

- Personal satisfaction and fulfilment

- Diversification of income sources

Cons to Consider:

- Time commitment required

- Initial investment or startup costs

- Potential stress or pressure

- Impact on work-life balance

- Unpredictable income

- Additional tax complications

- Possible conflicts with your main job

Remember, what might be a pro for one person could be a con for another. For instance, the flexibility of setting your own hours might be great for some, but others might struggle with the lack of structure.

Do a Risk Assessment

Every side hustle comes with its own set of risks.

Financial Risks:

- How much money do you need to invest upfront?

- What ongoing costs will you incur?

- How long before you expect to break even?

- What’s the worst-case financial scenario?

Legal Risks:

- Are there any licensing or insurance requirements?

- Could your side hustle potentially violate any non-compete agreements with your current employer?

- Are there any industry-specific regulations you need to be aware of?

Reputational Risks:

- How might this side hustle affect your professional reputation?

- Could it impact future job prospects?

- Are there any potential conflicts of interest with your main job?

Market Risks:

- How saturated is the market for your chosen side hustle?

- Is there a steady demand for your product or service?

- How vulnerable is your side hustle to economic downturns?

Work-Life Balance Implications

A side hustle shouldn’t come at the cost of your wellbeing. Carefully consider how it will fit into your life:

Time Management:

- How many hours per week can you realistically dedicate to your side hustle?

- Will you need to give up any current activities or hobbies?

- Can you maintain a healthy sleep schedule?

Stress Levels:

- How will the additional workload affect your stress levels?

- Do you have strategies in place to manage potential burnout?

Personal Relationships:

- How will your side hustle impact time with family and friends?

- Have you discussed your plans with your partner or family?

Leisure and Self-Care:

- Will you still have time for exercise and other self-care activities?

- Can you maintain a healthy work-life balance with this additional commitment?

Assess Potential Impact on Your Main Job

Your side hustle shouldn’t jeopardise your primary source of income. Consider:

Performance:

- Will the time and energy devoted to your side hustle affect your performance at your main job?

- Can you maintain the same level of focus and productivity?

Conflicts of Interest:

- Is there any overlap between your side hustle and your employer’s business?

- Does your employment contract have any clauses about outside work?

Career Progression:

- Could your side hustle enhance your skills in a way that benefits your main career?

- Alternatively, could it distract from advancing in your primary job?

Energy Levels:

- Will you have enough energy to perform well in both your main job and your side hustle?

- How will you manage if both become demanding simultaneously?

#6 Find The Best Side Hustles

You’ll have figured out by now that the best side hustle for one person would be a tragic waste of time and effort for another. Here’s a look at some popular side hustles, and who they might suit:

Freelancing (Writing, Design, Programming)

Freelancing offers flexibility and the ability to leverage professional skills. It’s an excellent option for those with marketable talents in areas like writing, graphic design, web development, or programming.

Pros:

- Flexibility to work from anywhere

- Potential for high hourly rates

- Opportunity to build a diverse portfolio

Cons:

- Inconsistent workload and income

- Need to constantly seek new clients

- Self-employment taxes and accounting responsibilities

Getting Started:

- Identify your niche and build a portfolio

- Create profiles on platforms like Upwork, Fiverr, or PeoplePerHour

- Network within your industry and seek referrals

Earning Potential:

Rates vary widely based on skill and experience. For example:

- Freelance writers might earn £30-£100+ per hour

- Graphic designers could charge £25-£150+ per hour

- Programmers often earn £50-£200+ per hour

Gig Economy Jobs (Delivery, Ride-sharing)

These jobs offer quick entry and flexible hours, making them popular choices for those seeking immediate income. If you’re looking for a guide in getting started with a gig economy side hustle, check out this post.

Pros:

- Low barrier to entry

- Flexible scheduling

- Immediate earnings

Cons:

- Wear and tear on personal vehicle

- Potentially long or unsociable hours

- Income can be unpredictable

Getting Started:

- Sign up with companies like Uber, Deliveroo, or Amazon Flex

- Ensure you meet all requirements (vehicle standards, insurance, etc.)

- Complete any necessary training or onboarding

Earning Potential:

- Ride-share drivers often earn £10-£15 per hour before expenses

- Food delivery drivers might make £8-£12 per hour plus tips

Remember to factor in costs like fuel and vehicle maintenance when calculating your net earnings.

Online Tutoring and Teaching

If you have expertise in a subject, consider online tutoring or teaching English as a foreign language.

Pros:

- Can be done from home

- Opportunity to make a positive impact

- Potential for repeat clients and steady income

Cons:

- May require specific qualifications

- Often involves working evenings or weekends

- Need for patience and strong communication skills

Getting Started:

- Obtain necessary qualifications (e.g., TEFL certificate for teaching English)

- Create profiles on platforms like TutorMe, VIPKid, or Chegg

- Develop a curriculum or teaching materials

Earning Potential:

- Online tutors typically earn £15-£40 per hour

- TEFL teachers might make £10-£20 per hour, with experienced teachers earning more

E-commerce and Dropshipping

Selling products online can be lucrative, but requires careful market research and initial investment.

Pros:

- Potential for passive income

- Scalability

- Opportunity to build a brand

Cons:

- Upfront investment required

- Need for storage space (unless dropshipping)

- Competitive market

Getting Started:

- Identify a niche and conduct market research

- Source products or set up relationships with suppliers

- Set up an online store (e.g., Shopify, Etsy, Amazon)

Earning Potential:

Highly variable. Successful e-commerce businesses can generate anywhere from a few hundred to several thousand pounds per month.

Rent Out Assets (Spare Room, Parking Space)

This can be a relatively passive income stream if you have unused space or assets.

Pros:

- Minimal ongoing work required

- Can generate income from existing assets

- Potential for steady, predictable income

Cons:

- May require initial preparation or investment

- Potential wear and tear on your property

- Need to deal with tenants or renters

Getting Started:

- Prepare your space (clean, furnish, etc.)

- List on platforms like Airbnb, SpareRoom, or JustPark

- Ensure compliance with local regulations and taxes

Earning Potential:

- Renting a spare room could generate £300-£800+ per month, depending on location

- Parking spaces in high-demand areas might earn £100-£200+ per month

Content Creation (YouTube, Blogging, Podcasting)

Creating content can be a fun and potentially lucrative side hustle for those with a passion for a particular topic.

Pros:

- Creative outlet

- Potential for passive income through ads or sponsorships

- Opportunity to build a personal brand

Cons:

- Can take time to build an audience

- Requires consistent effort and content creation

- May need investment in equipment (camera, microphone, etc.)

Getting Started:

- Choose your platform and niche

- Create and stick to a content schedule

- Engage with your audience and network within your niche

Earning Potential:

Varies widely. Successful content creators can earn from hundreds to thousands of pounds per month through ads, sponsorships, and related products or services.

Virtual Assistance

If you’re organised and have good administrative skills, becoming a virtual assistant could be a great option.

Pros:

- Can be done remotely

- Diverse range of tasks

- Potential for long-term client relationships

Cons:

- May involve irregular hours

- Need to juggle multiple clients and tasks

- Requires excellent time management skills

Getting Started:

- Identify your key skills and services

- Create profiles on platforms like Time Etc or PeoplePerHour

- Network and seek referrals from existing contacts

Earning Potential:

Virtual assistants typically earn £15-£35 per hour, with rates increasing with experience and specialised skills.

#7 Test the Waters

You don’t have to go all in on a side gig right away. I nearly bought a new car to start driving taxis in my spare time before I even knew if I had the time, energy and patience for it. There are ways to test your suitability for a side gig with room for an early exit if it doesn’t pan out the way you want it to.

Start Small and Gauge Your Interest and Commitment

Beginning with a small-scale version of your side hustle allows you to assess your enjoyment and dedication without overcommitting.

Set a Manageable Goal

Start with a modest, achievable goal. For example:

- If you’re considering freelance writing, aim to complete one or two small projects

- For e-commerce, try selling a limited number of items

- If tutoring, begin with just one or two students

Time-Box Your Experiment

Set a specific timeframe for your trial run, such as 30 days or 3 months. This gives you enough time to get a feel for the work without feeling overwhelmed.

Track Your Time and Effort

Keep a detailed log of:

- Hours spent on the side hustle

- Tasks completed

- Challenges faced

- Your feelings and energy levels throughout the process

Evaluate Your Performance and Satisfaction

Check in with yourself regularly, to gauge how you think and feel about your new gig.

Conduct a Skills Assessment

- Are you able to complete tasks to a high standard?

- What skills do you need to improve?

- Are there tools or training that could enhance your performance?

Check Your Enthusiasm Levels

- Do you look forward to working on your side hustle?

- Are you excited to learn more about the field?

- Does the work energise you or drain you?

Assess Work-Life Balance

- Can you manage the side hustle alongside your other commitments?

- Is it causing stress in other areas of your life?

- Are you able to maintain healthy habits (sleep, exercise, social time)?

Be Prepared to Pivot if Necessary

Flexibility is key in the early stages. If something isn’t working, be ready to adjust your approach or even explore different ideas.

Identify What’s Not Working

Be specific about the aspects of the side hustle that aren’t meeting your expectations. Is it the:

- Type of work?

- Client interactions?

- Financial returns?

- Time commitment?

Consider Adjustments

Before abandoning the idea completely, think about potential tweaks:

- Could you target a different market segment?

- Is there a related service you could offer that might be more suitable?

- Could you adjust your pricing or business model?

Explore Alternative Options

If you decide after your trial period that your new gig isn’t for you, don’t be discouraged. Use what you’ve learned to inform your next move:

- What aspects did you enjoy that you could carry into a different side hustle?

- What have you learned about your working style and preferences?

- Are there related fields that might be a better fit?

Conclusion: Choosing Your Perfect Side Hustle

Starting a new side hustle can be exciting and rewarding. It can also be draining and frustrating if you pick the wrong thing. I’ve done this before, trying to compete in markets with no experience, where the guy next to me has 10.

That doesn’t mean you can’t start something you’ve never done before, but just know that you might need a higher pain tolerance before you see success.

Lots of factors could influence how you pick a side gig.

Let’s recap the key steps we’ve covered:

- Assess your skills and interests to identify side hustle options that align with your strengths and passions.

- Determine how much time you have available to dedicate to your side gig, factoring in your current commitments.

- Evaluate potential earnings, considering not just the income but also the time investment and associated costs.

- Consider your long-term goals and how a side hustle can complement your career aspirations and personal development.

- Weigh the pros and cons, including the impact on your work-life balance and potential risks.

- Explore popular side hustle options, from freelancing and gig economy jobs to e-commerce and content creation.

- Test the waters by starting small, seeking feedback, and being prepared to pivot if necessary.

Remember, the perfect side hustle is one that not only provides additional income but also aligns with your lifestyle, values, and long-term objectives. It should be something you enjoy and can sustainably manage alongside your other commitments.

Don’t be discouraged if your first attempt isn’t an immediate success. Many successful entrepreneurs went through several iterations before finding their winning formula.

A well-chosen side gig can develop your skills, expand your network, and even open doors to new career paths.